Original artwork by Reed Olsen.

By Nate Omdal

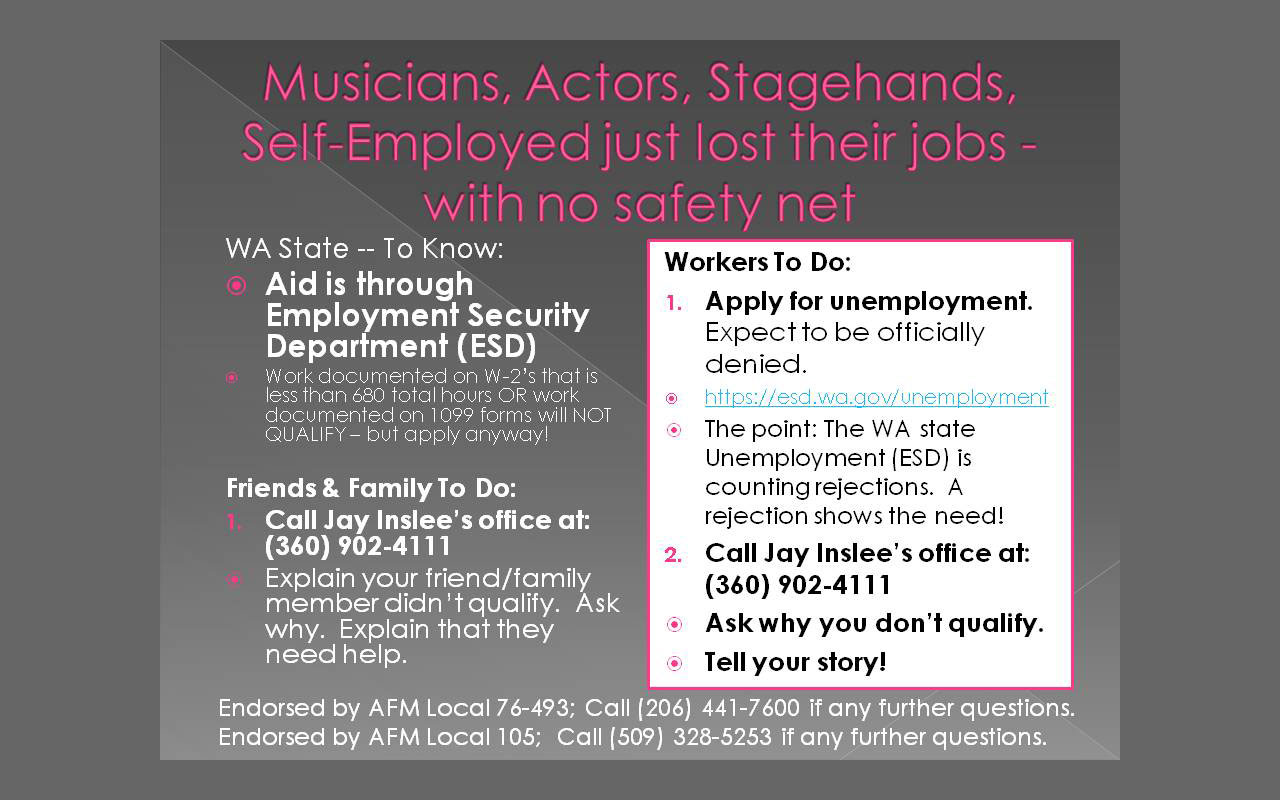

As the effects of COVID-19 continue to force a near total cancelation of the ways most musicians earn a living, many of us find ourselves without answers going forward. To make matters worse, many musician workers will not qualify for the extension of Washington State unemployment benefits.

Many of the hours we work (and pay taxes on) fall under “1099 miscellaneous income” and as such is not counted by the state. In order to qualify for WA Unemployment, the worker must log at least 680 hours of W-2 work. 1099 hours will not qualify. Many labor and worker groups across the state, including the Musicians Association of Seattle Local 76-493, are calling on all levels of government to find the broadest and most inclusive revision to the state’s emergency unemployment package. It is my opinion that the use of 1099 employment has been abused by many employers who are in fact large enough to offer a W2 wage. Many of the readers of Earshot would easily represent the group of subcontractors and workers who should reasonably be able to utilize the 1099 system for the gigs, weddings and events we all play. However, this quarantine is proving the need to have some kind of formalization of our workplaces. If you have any questions about ongoing worker advocacy efforts, please feel free to contact me at nate@local76-493.org and I will be happy to help you however I can. Thanks, and stay safe!